Recent developments in the AI chip market highlight significant advancements as companies rapidly push technological boundaries. AMD reported record annual revenue for 2024, largely driven by increased adoption of its EPYC processors and Instinct accelerators, with substantial growth seen in the Data Center segment. AMD continues to bolster its AI capabilities through strategic partnerships with companies like IBM and Vultr, aiming to enhance AI infrastructure for generative AI and HPC applications. Additionally, AMD has expanded its AI-focused product offerings across various sectors, including consumer electronics and high-performance computing (HPC), demonstrating its commitment to driving innovation in AI technology. These efforts underscore the competitive dynamics within the AI chip industry, as companies seek to capitalize on growing demand for high-performance computing solutions.

- Advanced Micro Devices last closed at $119.50 up 4.6%.

Elsewhere in the market, Infineon Technologies was a notable mover up 10.4% and ending the day at €34.50. This week, the company reported a significant decline in first-quarter earnings and sales compared to the previous year. In the meantime, Marvell Technology lagged, down 3.4% to end the day at $109.69.

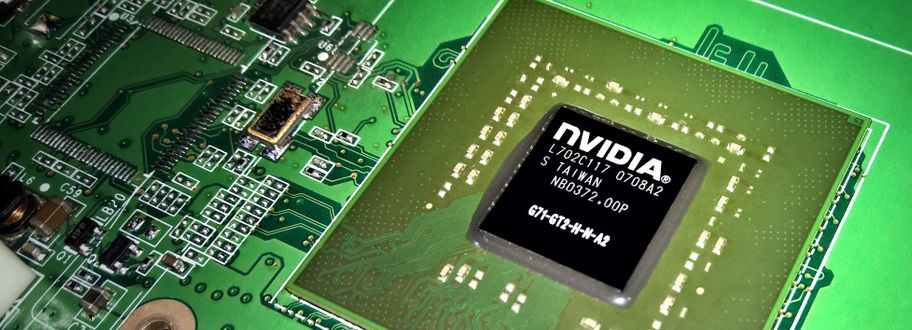

- NVIDIA finished trading at $118.65 up 1.7%.

- QUALCOMM closed at $173.04 up 1.6%.

- Intel finished trading at $19.29 down 0.5%, not far from its 52-week low.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.